With demand outpacing supply, Royal LePage adjusts forecast upward following stronger-than-expected start to 2023

First quarter highlights:

TORONTO, April 13, 2023 –According to the Royal LePage House Price Survey released today, the aggregate[1] price of a home in Canada decreased 9.2 per cent year-over-year to $778,300 in the first quarter of 2023. On a quarter-over-quarter basis, however, the aggregate price of a home in Canada rose 2.8 per cent, as buyers began to come off the sidelines following the Bank of Canada’s decision last month to pause interest rate hikes for the first time in a year.

TORONTO, April 13, 2023 –According to the Royal LePage House Price Survey released today, the aggregate[1] price of a home in Canada decreased 9.2 per cent year-over-year to $778,300 in the first quarter of 2023. On a quarter-over-quarter basis, however, the aggregate price of a home in Canada rose 2.8 per cent, as buyers began to come off the sidelines following the Bank of Canada’s decision last month to pause interest rate hikes for the first time in a year.

“There has been nothing ‘typical’ about Canada’s housing market since the start of the COVID-19 pandemic. Lockdowns brought the housing market to a grinding halt in early 2020 before the work-from-home revolution catapulted it into a two-year, all-season frenzy of record sales volumes and aggressive price growth,” said Phil Soper, president and CEO of Royal LePage. “As markets do, this market overshot, and the inevitable correction was triggered when the Bank of Canada began to rapidly raise interest rates. The downturn came swiftly, and the real estate industry remained depressed for twelve months, a longer correction than the aftermath of the financial crisis thirteen years ago. We have turned the corner and the housing economy is growing again; none too soon for many buyers, who have been waiting patiently for prices to bottom out.”

The Royal LePage National House Price Composite is compiled from proprietary property data, nationally and in 62 of the nation’s largest real estate markets. When broken out by housing type, the national median price of a single-family detached home declined 10.7 per cent year-over-year to $808,700, while the median price of a condominium decreased 6.7 per cent year-over-year to $571,700. Quarter-over-quarter, median prices for these two property segments were up 3.4 and 1.8 per cent, respectively. Price data, which includes both resale and new build, is provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian real estate valuation company.

“Sanity is slowly returning to the housing market,” added Soper. “While some buyer hopefuls will remain sidelined by a reduced capacity to borrow in this higher rate environment, our market data shows that many of those who chose to pause their search to see where prices and interest rates would land have resumed their home buying plans. Unfortunately, the challenge they must now deal with is a severe shortage of homes for sale.”

Royal LePage’s internal data and real estate boards across the country report that home sales have been trending upward since the start of the year, as buyer activity picks up. The number of available homes for sale, however, remains too low to satisfy demand.

In Canada’s major urban centres, sales and new listings are steadily increasing on a month-to-month basis, despite being down compared to this time last year.

“There remains a chronic shortage of housing supply in Canada, be it for rent or purchase. We are grappling with a growing problem here that once was the burden of our largest cities but is increasingly being felt in secondary markets as well,” Soper said. “Yes, governments are adopting policies intended to address the problem, yet the pace of progress is far from encouraging. And challenges facing developers – such as the increased cost of materials and labour, and a shortage of skilled tradespeople – persist.”

Public policy: ‘Not the right time to tighten restrictions’

This week, public consultations on changes to Canada’s mortgage stress test proposed by the Office of the Superintendent of Financial Institutions (OSFI) will close. The regulator is looking to impose even more restrictive access to mortgage financing in an effort to mitigate risk for major banks against potential consumer default.

“The mortgage stress test has proven to be an effective tool to ensure Canadians can meet their obligations to a lender in the event that interest rates increase, as they have this past year,” said Soper. “The legislation was introduced in 2018 when borrowing costs were very low and rates highly likely to rise. For OSFI to place new hurdles in the path of young Canadians’ pursuit of home ownership now, in an environment where rates are high and likely to fall, would be turning a blind eye to the macro-economic environment, and unnecessarily cruel. Further, such a move could do more harm than good, forcing families into the unregulated B-lender market.

“Despite a year of rapidly-rising interest rates, we see that the number of Canadian homeowners who have failed to meet obligations to their financial institution remains exceptionally low. Our banks have managed their mortgage portfolios well, and it helps that unemployment is very low,” added Soper.

Foreign buyers

Last month, the federal government revised the parameters of the two-year ban on foreign buyers, which came into effect on January 1st. The list of exemptions has been expanded to include non-Canadians who wish to purchase residential property for the purpose of development and vacant land zoned for residential and mixed-use, among other amendments.

“This policy was intended to deter foreign investors from parking money in Canadian properties that sit vacant. The government’s decision to allow further exemptions from the ban shows a willingness to tweak policy to meet the needs of our housing supply crisis,” added Soper.

B.C. Home Buyer Rescission Period

In British Columbia, the newly-implemented Home Buyer Rescission Period, a ‘cooling-off’ period that allows buyers the right to rescind an offer within three business days of an agreement being signed, has not proven to be useful.

“Few B.C. buyers are exercising their right to use the cooling-off period the way it was intended – to allow them an ‘out’ after a rash decision to purchase a property. Unfortunately, we are seeing people blatantly abusing the program by making offers on multiple homes as they shop around, locking up scant housing inventory as if clothing in a retail store. The legislation is harmful, not helpful, and should be amended or scrapped.”

Interest rates

The Bank of Canada’s overnight lending rate is holding at 4.5 per cent.[2] The central bank has indicated that it will maintain the rate at its current level if inflation continues to come down. However, they will not hesitate to raise interest rates again in the future if necessary.

“This was the signal that so many Canadians were waiting for. The Bank of Canada’s rate hold was the green light that stability is returning to the market, and it has had a swift and significant impact on buyer demand,” said Soper.

A recent Royal LePage survey[3] found that nearly one quarter of Canadians (24%) were in the market for a new home over the last year, and 63 per cent of them said they postponed their plans due to rising interest rates. Of those who put their plans on hold, 26 per cent said they plan to resume their search this spring, and another 36 per cent said they would return to the market in the near future, once the Bank of Canada holds rates for several consecutive months.

Forecast

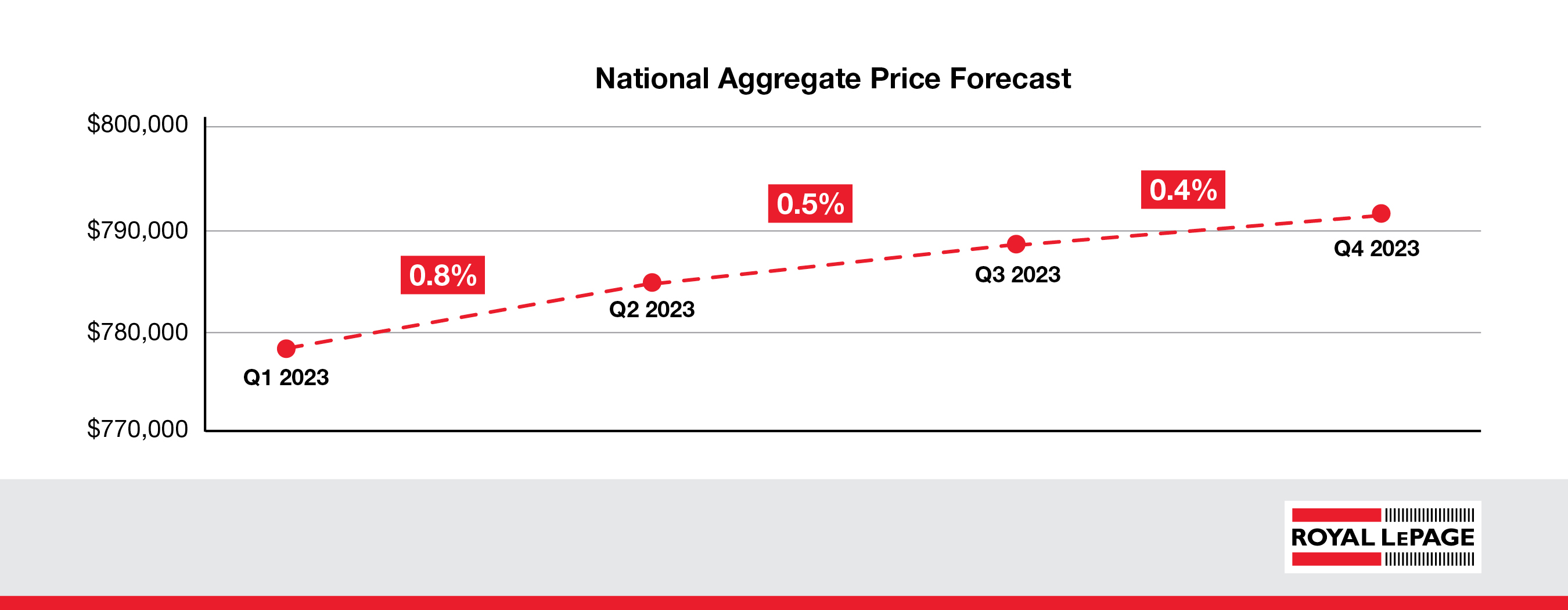

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 4.5 per cent in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast has been revised upward to reflect an earlier-than-expected boost in activity in Canada’s major housing markets.

“Coming out of a correction, it is common to underestimate the speed at which the market will turn itself around. As market activity is rebounding quicker than anticipated, we are looking ahead with a sense of cautious optimism,” noted Soper. “While we do not expect huge price gains this year, some sense of normalcy is returning to the market.”

Following activity levels in the first quarter of 2023 that surpassed the Company’s expectations – a vigorous return of buyer demand coupled with ultra-low housing supply conditions – Royal LePage has adjusted its quarterly forecast for the remainder of the year. On a quarter-over-quarter basis, the national aggregate home price is expected to continue rising modestly but steadily over the next nine months.

Royal LePage House Price Survey Chart:rlp.ca/house-prices-Q1-2023

Royal LePage Forecast Chart:rlp.ca/market-forecast-Q1-2023

REGIONAL SUMMARIES - click HERE